Using MACD for Trade Signals: A Guide for Traders

Using MACD for Trade Signals

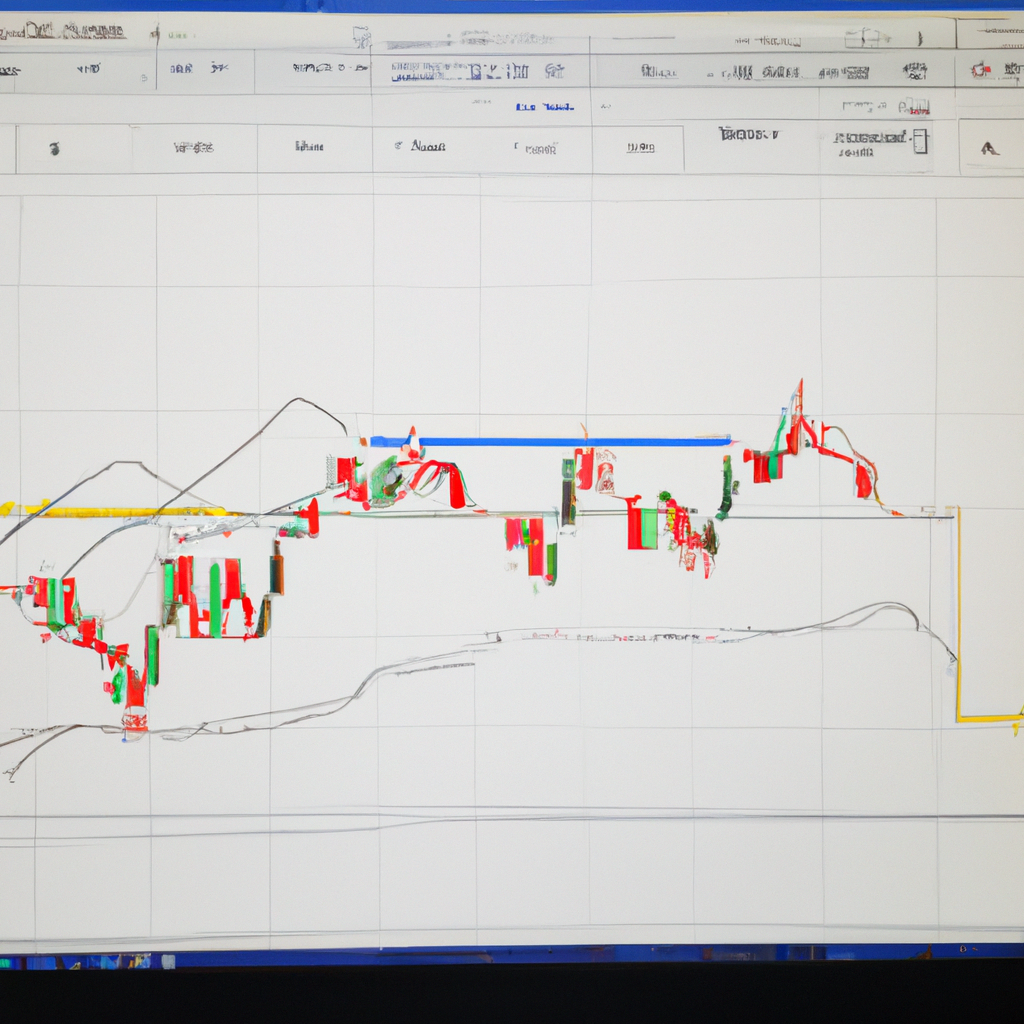

MACD, which stands for Moving Average Convergence Divergence, is a popular technical indicator used by traders to identify potential buy or sell signals in the market. By analyzing the relationship between two moving averages, MACD can help traders spot trends and momentum shifts. Here are some tips on how to use MACD for trade signals:

Understanding MACD Components

MACD consists of three main components:

- MACD Line: This is the faster moving average, calculated by subtracting the 26-period Exponential Moving Average (EMA) from the 12-period EMA.

- Signal Line: This is the slower moving average, typically a 9-period EMA of the MACD Line.

- MACD Histogram: This is the difference between the MACD Line and the Signal Line, plotted as a histogram.

Identifying Buy Signals

One common strategy for using MACD is to look for buy signals when the MACD Line crosses above the Signal Line. This crossover indicates that the shorter-term moving average is starting to outpace the longer-term moving average, suggesting a potential uptrend. Traders may also look for bullish divergence between the MACD Line and the price chart, which can signal a reversal in the current trend.

Identifying Sell Signals

Conversely, traders can look for sell signals when the MACD Line crosses below the Signal Line. This crossover suggests that the shorter-term moving average is falling below the longer-term moving average, indicating a potential downtrend. Additionally, bearish divergence between the MACD Line and the price chart can signal a reversal to the downside.

Confirming Signals with Other Indicators

While MACD can be a powerful tool for identifying trade signals, it is always recommended to confirm signals with other technical indicators or analysis techniques. Traders may use tools such as trendlines, support and resistance levels, or other oscillators to validate their trading decisions before entering a position.

Managing Risk and Setting Stop Losses

As with any trading strategy, it is crucial to manage risk and protect your capital. Traders should always set stop-loss orders to limit potential losses in case the trade goes against them. By using MACD for trade signals in conjunction with proper risk management techniques, traders can increase their chances of success in the market.

In conclusion, MACD can be a valuable tool for identifying trade signals and spotting potential trends in the market. By understanding the components of MACD, interpreting buy and sell signals, and confirming signals with other indicators, traders can make informed decisions and improve their trading performance.