Interpreting MACD Histogram: Key Signals for Market Trends

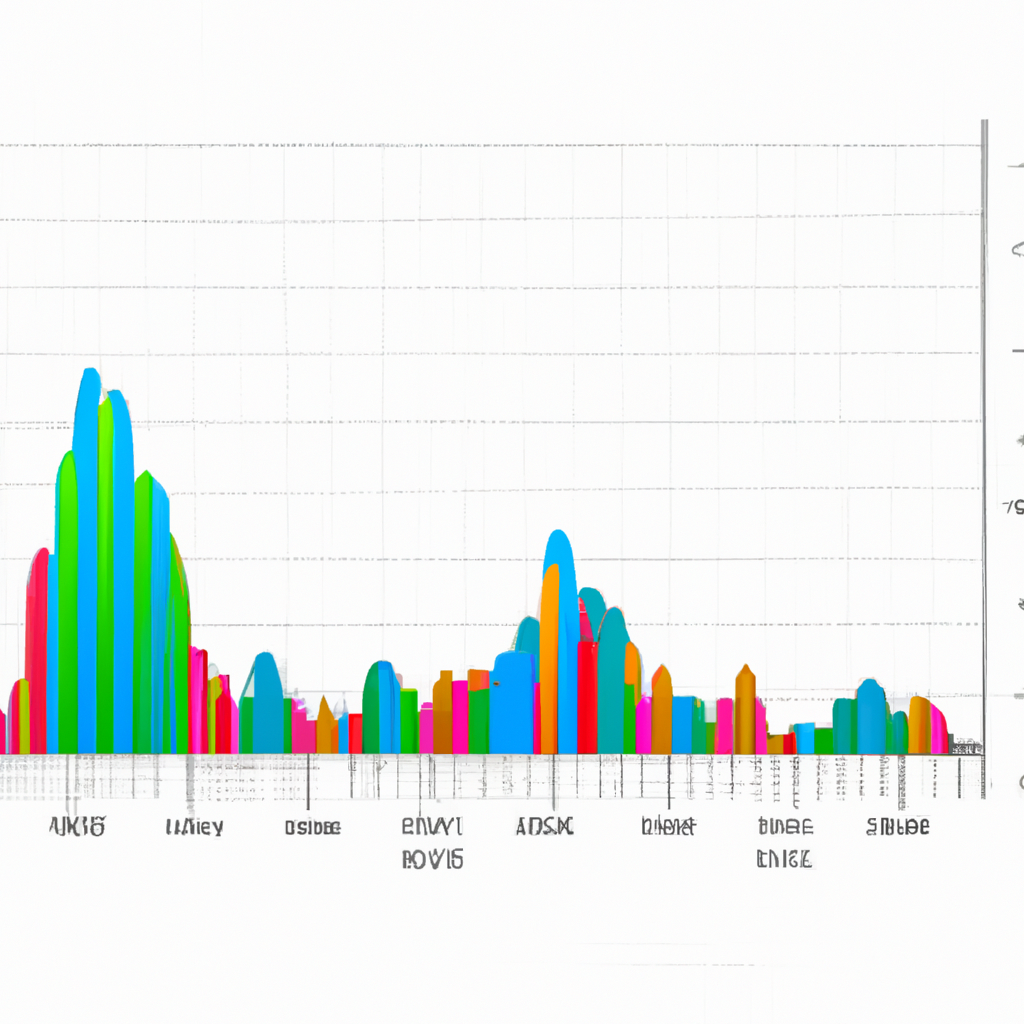

Interpreting MACD Histogram

The Moving Average Convergence Divergence (MACD) histogram is a popular technical analysis tool that helps traders identify potential trends and momentum shifts in the market. The MACD histogram is derived from the MACD line and the signal line, which are both based on moving averages. Here are some common interpretations of the MACD histogram:

1. Positive Histogram

When the MACD histogram is above the zero line and moving higher, it indicates that the short-term moving average is above the long-term moving average. This suggests that the current trend is bullish and gaining momentum. Traders may interpret this as a signal to enter a long position or hold onto existing long positions.

2. Negative Histogram

Conversely, when the MACD histogram is below the zero line and moving lower, it indicates that the short-term moving average is below the long-term moving average. This suggests that the current trend is bearish and losing momentum. Traders may interpret this as a signal to enter a short position or hold onto existing short positions.

3. Divergence

One of the key signals that traders look for in the MACD histogram is divergence. Divergence occurs when the price of an asset is moving in the opposite direction of the MACD histogram. For example, if the price is making higher highs while the MACD histogram is making lower highs, it could signal a potential trend reversal. Traders may use this signal to anticipate a change in market direction.

4. Convergence

Convergence is the opposite of divergence and occurs when the price of an asset is moving in the same direction as the MACD histogram. This indicates that the current trend is strong and likely to continue. Traders may use this signal to confirm the strength of the current trend and stay in their positions.

5. Zero Line Cross

Another common interpretation of the MACD histogram is the zero line cross. When the MACD histogram crosses above the zero line, it signals a potential bullish trend reversal. Conversely, when the MACD histogram crosses below the zero line, it signals a potential bearish trend reversal. Traders may use this signal to enter or exit positions based on the direction of the cross.

Overall, the MACD histogram is a versatile tool that can provide valuable insights into market trends and momentum. By understanding how to interpret the MACD histogram, traders can make more informed decisions and improve their trading strategies.