Demystifying Elliott Wave Forecasting Models

# Understanding Elliott Wave Forecasting Models

The Elliott Wave Theory is a complex but incredibly insightful tool used in the field of technical analysis in financial markets. Developed by Ralph Nelson Elliott in the 1930s, it provides a framework for forecasting market trends by identifying extremes in investor psychology, highs and lows in prices, and other collective factors.

##

The Foundation of Elliott Wave Theory

At its core, Elliott Wave Theory posits that the movement of market prices can be predicted by identifying a recurring pattern of waves. According to Elliott, these waves are a result of investor sentiment and psychology which tend to move between optimism and pessimism in natural sequences. The theory breaks down market movements into waves that follow a specific structure.

##

Main Components of Elliott Wave Theory

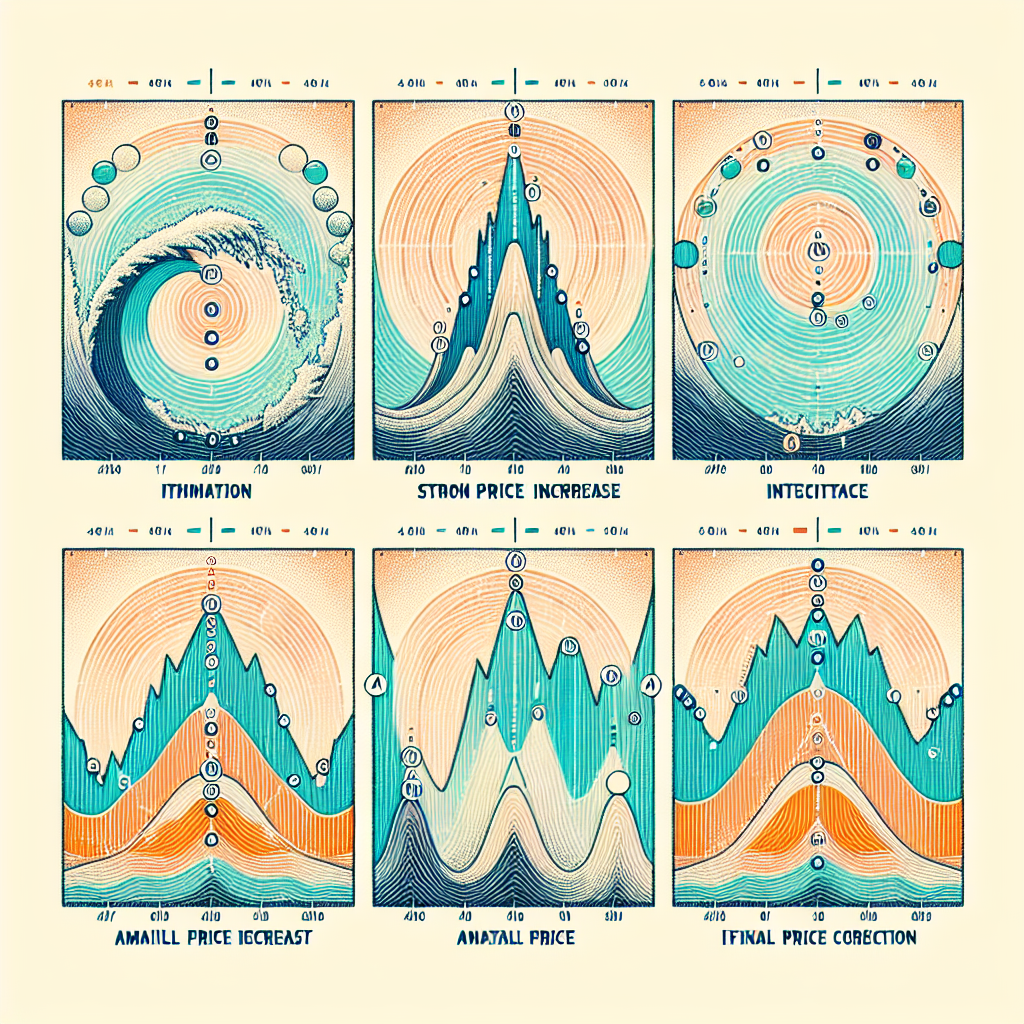

Elliott Wave Theory consists of two main wave patterns: Impulse Waves and Corrective Waves, which help in understanding market trends.

###

Impulse Waves

Impulse waves consist of five sub-waves that move in the same direction as the trend of the next higher size. These five waves are made up of three motive waves, numbered 1, 3, and 5, moving in the direction of the trend, interspersed with two corrective waves, numbered 2 and 4. This forms a pattern of ‘5-3 wave’ structures that underpin the market’s primary direction.

###

Corrective Waves

In contrast, corrective waves move against the trend of the next higher degree. These typically unfold in three main patterns: Zigzag (5-3-5), Flat (3-3-5), or Triangle (3-3-3-3-3). Each of these patterns reflects market corrections or periods of consolidation before the trend resumes.

##

Applying Elliott Wave Theory for Market Forecasting

Elliott Wave forecasting involves several steps from identifying wave patterns to applying them for trading decisions. Here’s a simplified approach:

###

Identifying Wave Patterns

Initially, analysts need to discern the current wave patterns in market charts. This involves distinguishing between impulse and corrective waves and determining their stage within the broader market cycle.

###

Wave Degree

Elliott Wave Theory operates across different wave degrees, from grand supercycle (lasting centuries) down to sub-minuette (lasting minutes). Identifying the correct wave degree is crucial for accurate forecasting and applies scales to current market activities.

###

Rules and Guidelines

There are specific rules and guidelines within Elliott Wave Theory that help ensure the correct interpretation of patterns. For example, Wave 2 never retraces more than 100% of Wave 1, Wave 3 is never the shortest among Waves 1, 3, and 5, etc. These principles aid in validating the wave count.

##

Leveraging Elliott Wave Theory for Trading

Elliott Wave Theory offers a lens through which to view market movements with greater clarity. Traders use it to anticipate price movements, entry and exit points, and potential market reversals.

###

Identifying Entry and Exit Points

By determining the positions within the wave patterns, traders can identify high-probability entry points during the start of Wave 3 or Wave C of a corrective pattern, and exit points at the end of Wave 5 or Wave C.

###

Risk Management

An inherent part of trading, risk management can be enhanced with Elliott Wave Theory by setting stop-loss orders based on wave patterns, thus minimizing potential losses.

##

Challenges and Criticisms

Though powerful, Elliott Wave Theory is not without its critics. The subjective nature of wave identification, the theory’s complexity, and the potential for multiple valid interpretations add to its criticisms. However, when used with other technical analysis tools, it can enhance a trader’s understanding of market movements.

##

Conclusion

Elliott Wave Forecasting Models provide a dynamic and insightful framework for analyzing market trends. Despite its complexities and challenges, its application can significantly bolster the toolbox of any technical analyst or trader aiming to decode market behaviors and improve their trading strategies. Like any forecasting method, the best results come from combining Elliott Wave Theory with other technical, fundamental, and sentiment analysis techniques.