Technical analysis

Mastering Backtesting with Historical Data

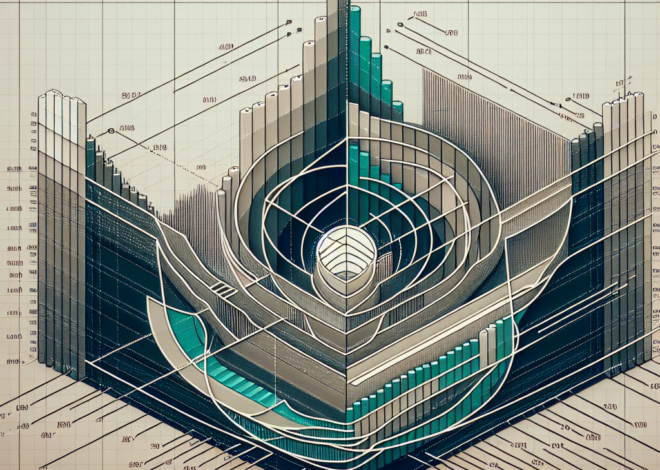

# Backtesting with Historical Data Backtesting is a critical procedure in the financial, trading, and investment sectors that involves assessing the viability of a trading strategy or model by applying it to historical data. This retrospective application enables traders and investors to gauge how a particular strategy would have performed in the past, thereby providing […]

Mastering Fibonacci Extensions in Market Trading

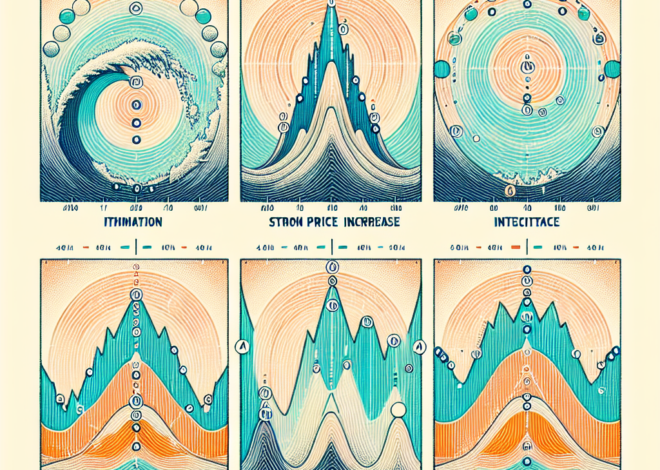

Understanding Fibonacci Extensions in Trading Fibonacci extensions are a tool that traders and investors use to anticipate potential areas of support or resistance in the markets. They are based on the Fibonacci sequence, a series of numbers where each number is the sum of the two preceding ones. This sequence has been found to have […]

A Comprehensive Guide to Pivot Point Trading Strategies

# Mastering Pivot Point Trading Strategies Pivot points are a versatile and widely used tool among traders for identifying potential support and resistance levels in the financial markets. These points are calculated using the high, low, and close prices of the previous trading day and can be applied to a variety of trading strategies across […]

Mastering Fibonacci Trading: Extensions Explained

Introduction to Fibonacci Trading with Extensions Fibonacci trading is a technique used by traders to identify potential support and resistance levels based on key Fibonacci numbers. This method is highly popular among traders due to its ability to predict market movements with a remarkable degree of accuracy. Fibonacci extensions, a tool derived from this concept, […]

Demystifying Elliott Wave Forecasting Models

# Understanding Elliott Wave Forecasting Models The Elliott Wave Theory is a complex but incredibly insightful tool used in the field of technical analysis in financial markets. Developed by Ralph Nelson Elliott in the 1930s, it provides a framework for forecasting market trends by identifying extremes in investor psychology, highs and lows in prices, and […]

Managing Trading Risks with Technical Analysis

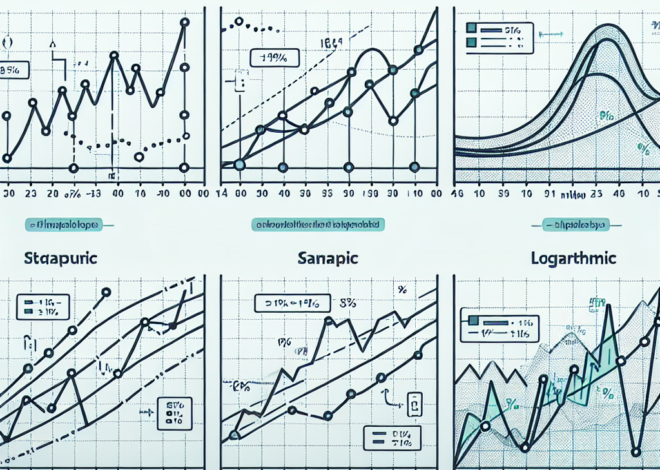

Introduction to Risk Management in Trading Risk management is a critical component of successful trading, ensuring that a trader can survive the ups and downs of the market and keep potential losses within tolerable limits. While traders employ several strategies to manage risk, integrating technical analysis can greatly enhance the effectiveness of these methods. Technical […]

Mastering Trend Line Drawing Techniques in Trading

Introduction to Trend Line Drawing Trend lines are essential tools in technical analysis for both stock market and forex trading, enabling traders to visualize and predict the future direction of an asset’s price movement. Correctly drawing trend lines can help identify support and resistance levels, signaling potential buy or sell opportunities. This article will explore […]

How to Master Risk Management in Trading

Introduction to Risk Management in Trading Risk management in trading involves identifying, assessing, and prioritizing risks followed by the coordinated and economical application of resources to minimize, control, and monitor the probability or impact of unfortunate events. Recognizing the inherent risks in trading and managing them effectively is crucial for both novice and seasoned traders […]

Mastering Pivot Point Trading Strategies: Tips for Success

Pivot Point Trading Strategies Pivot points are a popular technical analysis tool used by traders to identify potential support and resistance levels in the financial markets. By using pivot points, traders can make more informed decisions about when to enter or exit trades. In this article, we will discuss some common pivot point trading strategies […]

Using RSI Divergence for Effective Trade Entry

Understanding RSI Divergence for Trade Entry Relative Strength Index (RSI) is a popular technical indicator used by traders to identify overbought or oversold conditions in the market. RSI divergence is a powerful tool that can help traders spot potential trade entry opportunities. In this article, we will discuss how to use RSI divergence for trade […]