Effective Strategies for Preserving Your Capital

Investment Strategies for Capital Preservation

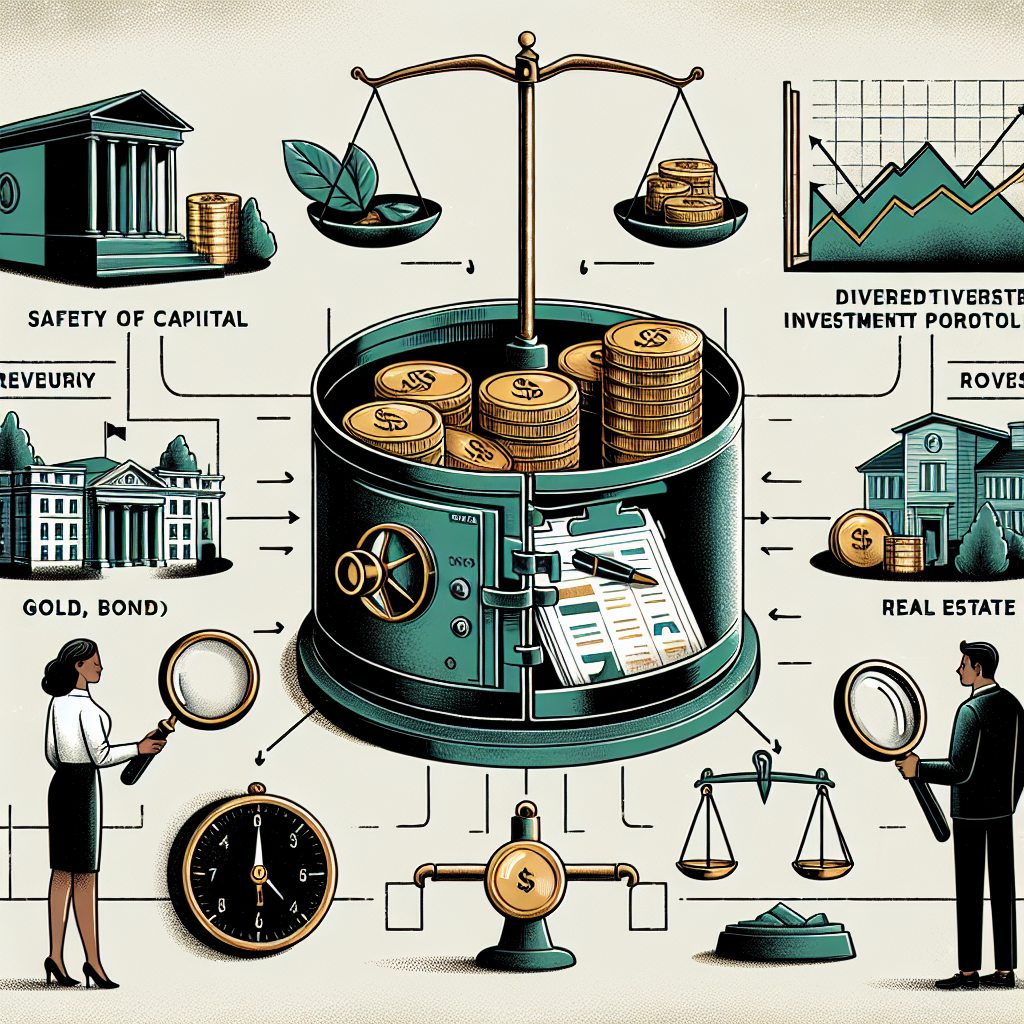

Capital preservation is an investment strategy aimed at preventing loss in an investor’s portfolio. This strategy is particularly appealing to those nearing retirement or individuals who prefer a low-risk investment approach. The goal is to maintain the purchasing power of one’s capital with minimal risk of loss. Below, we delve into some pivotal strategies ideal for capital preservation.

Understanding Capital Preservation

Capital preservation revolves around safeguarding the absolute value of your investment. This does not mean that the value of the investment will never decrease, but the strategy is designed to minimize risk and protect against significant losses. It’s a conservative approach, balancing potential returns against the risk of losing principal investment.

Diversification

A well-diversified portfolio is a foundational element of capital preservation. Diversification reduces risk by spreading investments across various asset classes, such as stocks, bonds, and cash equivalents. Through diversification, the negative performance of one investment can be offset by the positive performance of another.

Asset Allocation

Proper asset allocation is crucial. It involves dividing investments among different categories to achieve a desired risk-reward balance. For capital preservation, a higher allocation to bonds and cash equivalents compared to stocks is generally advisable since they offer lower volatility.

Geographical Diversification

Investing in multiple geographical locations can also provide a cushion against local economic downturns. Global diversification ensures that your investment is not overly exposed to the economic conditions of a single country.

Fixed Income Investments

Fixed income investments, such as bonds and treasury securities, are cornerstone assets for capital preservation. They provide regular income, and their principal amount is usually returned upon maturity, barring issuer default.

Treasury Securities

U.S. Treasury securities are considered one of the safest investments as they are backed by the full faith and credit of the U.S. government. They include Treasury Bills, Notes, Bonds, and Inflation-Protected Securities (TIPS), each offering returns at low risk.

Corporate Bonds

Corporate bonds can also be part of a capital preservation strategy. However, selecting bonds from financially stable companies or those with higher credit ratings (investment-grade) is essential to minimize the risk of default.

FDIC-Insured Bank Products

FDIC-insured bank products offer a safe haven for capital preservation, providing protection and peace of mind up to the insured limit.

High-Yield Savings Accounts

These accounts offer higher interest rates than traditional savings accounts and are FDIC insured, making them a secure option for capital preservation.

Certificates of Deposit (CDs)

CDs are time-bound deposit accounts that typically offer higher interest rates than savings accounts. The interest rate is fixed, and the principal is returned at the end of the term. CDs are also insured by the FDIC, adding a layer of security.

Money Market Funds

Money market funds are a form of mutual funds that invest in short-term, high-quality debt securities. While not insured by the FDIC, they are considered low-risk investments, suitable for capital preservation.

Real Estate Investment Trusts (REITs)

For diversification, including a small proportion of REITs might be beneficial. REITs invest in property and typically offer regular dividends. While real estate can be volatile, publicly traded REITs offer liquidity and can be a relatively stable income source.

Conclusion

When pursuing a capital preservation strategy, it’s critical to prioritize safety and liquidity over high returns. This conservative approach suits investors close to retirement or those with a low tolerance for risk. The key is to focus on diversification, quality investments, and financial products that offer security and stability for your capital. Consulting with a financial advisor can also provide personalized advice tailored to your financial situation and goals.