Mastering Common Chart Patterns: A Guide for Traders

Identifying Common Chart Patterns

Introduction

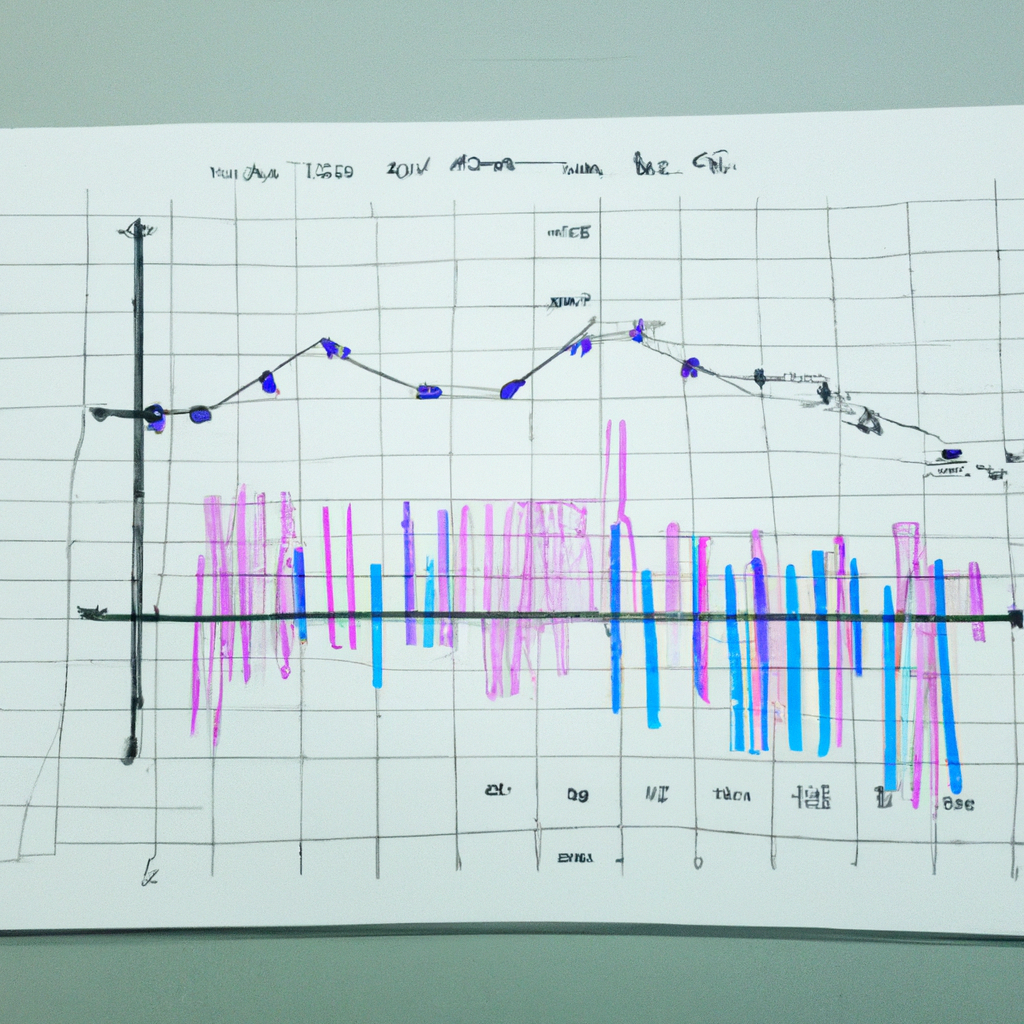

Chart patterns are visual representations of price movements in the stock market. By identifying these patterns, traders can make more informed decisions about when to buy or sell a stock. In this article, we will discuss some of the most common chart patterns and how to recognize them.

Head and Shoulders

One of the most well-known chart patterns is the head and shoulders pattern. This pattern consists of three peaks, with the middle peak (the head) being higher than the other two (the shoulders). The neckline is a line drawn connecting the lows of the two shoulders. A break below the neckline is a signal to sell.

Double Top/Bottom

The double top pattern occurs when a stock reaches a high price, retraces, and then reaches that high price again before reversing. This is a bearish signal. The double bottom pattern is the opposite, signaling a bullish reversal.

Triangles

Triangles are chart patterns that form when the price of a stock consolidates between two converging trendlines. There are three main types of triangles: symmetrical, ascending, and descending. A breakout above or below the trendlines can signal a continuation of the current trend.

Flags and Pennants

Flags and pennants are short-term continuation patterns that form after a strong price movement. Flags are rectangular-shaped patterns, while pennants are small symmetrical triangles. A breakout in the direction of the initial trend can signal a continuation of that trend.

Cup and Handle

The cup and handle pattern is a bullish continuation pattern that resembles a tea cup with a handle. The cup is a rounded bottom, followed by a small consolidation (the handle). A breakout above the handle can signal a bullish continuation.

Conclusion

By learning to identify common chart patterns, traders can gain a better understanding of market trends and make more informed trading decisions. These patterns can provide valuable insights into potential price movements and help traders anticipate market movements. It is important to remember that no chart pattern is foolproof, and it is always important to use other technical indicators and risk management strategies in conjunction with pattern recognition.